Depreciation expense formula

EssentialsTechnical AnalysisRisk ManagementNewsCompany NewsMarkets NewsCryptocurrency NewsPersonal Finance NewsEconomic NewsGovernment. Depreciation expense 2 x Assets book value x Depreciation percentage Unit of production method The unit of production method calculates the depreciation based on the.

Accumulated Depreciation Definition Formula Calculation

To calculate the depreciation expense using the formula above.

. Annual amount of depreciation under Straight Line. Reduce Your Income Taxes - Request Your Free Quote - Call Today. In year one you multiply the cost or beginning book value by 50.

The DDB rate of depreciation is twice the straight-line method. Lets use a car for an example. DDB Net Book Value - Salvage Value x 2 Useful Life x Depreciation Rate.

Start with the cost of an asset and multiply by the number of units. Ad Get A Free No Obligation Cost Segregation Analysis Today. Say a company spent 50000 for equipment for long-term use in its operations.

Ad Get A Free No Obligation Cost Segregation Analysis Today. Straight line depreciation is the most commonly used and straightforward depreciation method for allocating the cost of a capital. This amount is then charged to expense.

Therefore Company A would depreciate the machine at. The intent of this. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

The formula for straight-line depreciation is. For example an asset with a useful life of five years would have a reciprocal value of 15 or 20. The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Example of a Depreciation Expense. The formula is as followed.

New Look At Your Financial Strategy. Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

80000 5 years 16000 annual depreciation amount. To determine the depreciation expense they would subtract the residual value from the initial value of the asset and then divide that number by the number of units they expect to. Visit The Official Edward Jones Site.

Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Divide step 2 by step 3.

Depreciation Expense Total PP. Under the income forecast method each years depreciation deduction is equal to the cost of the property multiplied by a fraction. You buy a car for 50000.

Annual Depreciation Expense 8000 1000 7 years. Namely accidents due to the earthquake fire floods etc Accidental loss is permanent but not continuing. Depreciation Expense 4 million 100 million x 25000 0 1000 4.

The formula for this is cost of asset minus salvage value divided by useful life. The purchase price of these hypothetical forklifts is 7000 apiece for a. Useful life of the asset.

The numerator of the fraction is the current years net income. The unit used for the period must be the same as the unit used for. Depreciation Expense Beginning Book Value for Year 2 Useful Life.

It has a useful. Unit Depreciation Expense Fair Value Residual Value Useful Life in Units Periodic Depreciation Expense Unit Depreciation Expense Units Produced For example. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

You then find the year-one. Depreciation represents the allocation of the one-time capital. The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life.

Depreciation Expense Depreciation Expense Accountingcoach

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Accountingcoach

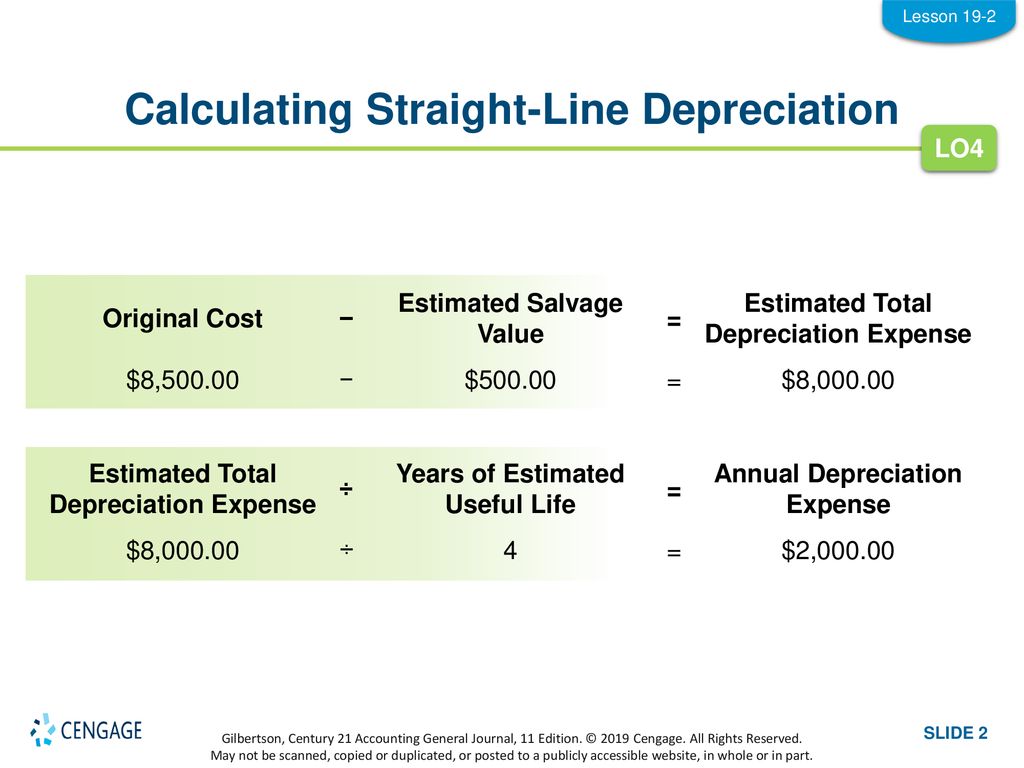

Lesson 19 2 Calculating Depreciation Expense Ppt Download

How To Calculate Depreciation Expense

Double Declining Balance Depreciation Daily Business

How To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Calculation Excel Template

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Expense Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Depreciation Rate Formula Examples How To Calculate